Buying a car through the CSD. EDIT Revised criteria on page 21 TeamBHP

8. Think about your brand. Your company car will be an extension of your business, so you'll want to make sure that whatever vehicle you choose is relevant to your brand. Not every industry prioritizes aesthetics, but consider whether your car needs to impress your clientele or keep up with the competition.

Maximizing Benefits Buying a Car Through Your Limited Company

The ability to claim back VAT is another financial incentive to leasing through your limited company. Generally speaking, you can recoup 50% of the VAT on lease payments if your business is VAT-registered. In practical terms, if your car costs £300 + VAT per month, you'd save £60 per month by paying for it via your limited company.

Buying a car through your business limited company

The transport sector, in fact, is the fastest growing sector among all emissions sources. In particular, land transport is a major carbon emitter: according to recent ITF data, CO2 emissions from global surface passenger transport will grow by between 30% and 110% by 2050 (ITF Transport Outlook 2015), depending on fuel prices and urban.

The Financial Obligations of Car Ownership

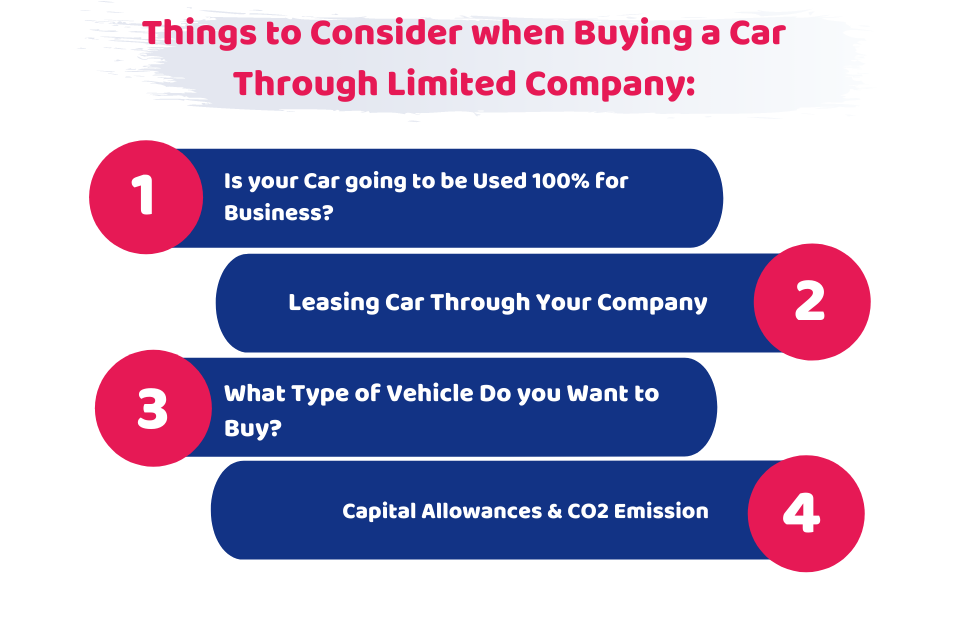

Buying a car via your limited company makes it a business fixed asset, you need to obtain tax relief via capital allowances on its purchase value to reduce the taxable profit in your tax return. However, it is worth bearing in mind that the capital allowances for cars are determined by their CO2 emissions - the higher the emissions, the less.

Buying a car through a dealership YouTube

When leasing a vehicle, your company won't actually own it, meaning you can't claim any capital allowances. However, it also means you're able to claim it as a business expense, allowing you to pay for 100% of the monthly leasing costs through your company's profits- so long as the vehicle's CO2 emissions are under 130g/km.

Can I Buy a Car Through My Business? (Limited Company / Sole Trader)

The tax impact: An example. A company purchases a fully electric car for £50,000 including VAT. A basic rate taxpayer director will use this as a company car, including personal trips. Corporation tax savings of £12,500 (£50,000 @ 25%) VAT reclaim of £4,167. Benefit in Kind of £1,000 (£50,000 @ 2%) taxed as below.

Things to Consider when Buying a Car Through Limited Company

Buying a car through your limited company sounds like a great way to save tax. But in most cases, it's more tax-efficient to buy the car privately and claim mileage. In this blog, we'll explain why this is and what you can claim. To keep things simple, this blog only applies to company directors buying cars.

Should I Lease a Car Through My Limited Company or Personally? Lease Fetcher

Three ways you can buy a vehicle through a limited company. Purchasing the vehicle outright. Like acquiring any other asset for your company, you can purchase a vehicle by paying the purchase price in full. This can help simplify your accounting if you're just starting out as you won't have to calculate and expense the interest you would.

5 Tips on Buying a New or Used Car Amid Inflation The Roanoke Star News

Essentially there are three categories of car to consider for Capital Allowances claims. If the car's CO2 emissions are 75g/km or less, you can deduct 100% of the cost of the car from the company's profits in the year that you buy the car, provided that the car is purchased brand new. If the CO2 emissions are between 76g/km and 130g/km then.

AutoDeal now allows consumers to buy cars online through its platform Frontier Digital Ventures

Step 3- Obtaining a Car Loan Using Your Business Name. Finance in your company name. You have two options for financing: you can get a loan from the dealership or shop around for a car loan at nearby banks and credit unions. Never forget to mention that you are applying for a loan in the name of your company.

Our Top 7 New Car Buying Tips Bankrate

Purchasing a car through your limited company. The tax treatment of the purchase costs depends on how the vehicle is financed. If a loan is taken out to purchase the vehicle or the vehicle is purchased on Hire Purchase, only the interest payments are an allowable company expense. Your company is also able to claim Capital Allowances to gain.

Car Buying Process How to Buy New and Used Car Online? Droom

Here are some of the benefits of buying a car through your limited company. Simplified Administration. By buying a car through your limited company, you streamline the administrative tasks associated with vehicle ownership. Your company will handle the car's registration, insurance, and maintenance, saving you time and effort.

The Smart Consumer's Guide to Buying a Car Saving N Spending Saving N Spending

The way you buy a car through a limited company does affect cash, accounting, and tax treatment. Look at the following common options and the potential outcomes of each to see what works best for your business situation. 1. Buy a car outright. Your business can buy a car outright through a limited company.

Save Tax Buying A Car In Your Limited Company Save Tax

Resale Value: Consider the car's depreciation and potential resale value. Environmental Impact: Opting for eco-friendly vehicles can align with corporate responsibility goals. Conclusion: Buying a car through a limited company requires careful consideration of the tax implications, financial benefits, and the specific needs of your business. Analyze both the immediate and long-term impacts.

7 Common Mistakes When Selling a Vehicle and How to Avoid Them

1. You buy (or lease) the car privately, just as you would if you weren't a company director. 2. You keep a log of your business travel. This is simply the number of miles you drive in your car for business purposes. Trips to clients, suppliers, conferences, training days and your accountant all count as business travel.

Buying a Car Through Your Limited Company Bizdaq

Car benefit charge example - registered after 6th April 2020. So, for a new car with a £30,000 list price and CO2 emissions of 110g/km, the car benefit charge for 2023/24 is 27% of the list price = £8,100. You then multiply this charge by the personal income tax band the charge will fall into - basic (20%), higher (40%), or additional (45%).